Chapter 2 Elementary Strategies

第二章 初级策略

The trader who enters an option market for the first time may find himself subjected to a form of "contract shock." Unlike a trader in equities or futures, whose choices are limited to a small number of instruments, an option trader must often deal with a bewildering assortment of contracts. With at least three different expiration months, with each month having several different exercise prices, and with both calls and puts available at each exercise price, it is not unusual for an option trader to be faced with as many as 40 different contracts.

第一次进入期权市场的交易者可能会经历一种 “合约冲击”。与股票或期货交易者不同,他们的选择仅限于少量的交易品种,而期权交易者常常需要面对种类繁多的合约。在至少三个不同的到期月份中,每个月都有多个不同的行权价,并且每个行权价下都有看涨期权和看跌期权可供选择。因此,期权交易者通常会面临多达 40 种不同的合约。

Even if we eliminate the inactively traded options, a new trader may still have to deal with 15 or 20 different options. With so many choices available, a trader needs some logical method of deciding which options actually represent profit opportunities. Which should he buy? Which should he sell? Which should he avoid altogether? The choices are so numerous that many prospective option traders give up in frustration.

即使我们排除交易不活跃的期权,新手仍然可能需要面对 15 到 20 种不同的期权。面对如此众多的选择,交易者需要一种合理的方法来判断哪些期权实际上具有盈利机会。他应该买入哪些期权?应该卖出哪些期权?哪些期权完全应该避免?选择如此繁多,以至于许多潜在的期权交易者感到沮丧而放弃。

For the trader who does persevere, a certain logic in the pricing of options begins to emerge. As he becomes familiar with this logic, he can begin to formulate potentially profitable strategies. Initially he will concentrate on the purchase or sale of individual options. From there he will go on to combination strategies. Eventually he will become comfortable with complex strategies involving several different contracts.

对于那些坚持不懈的交易者来说,在期权定价中会逐渐显现出某种逻辑。当他对这种逻辑变得熟悉时,就能开始制定潜在的盈利策略。最初,他将专注于单一期权的买入或卖出。随后,他会转向组合策略。最终,他将能够熟练运用涉及多种不同合约的复杂策略。

期权对新手的冲击十分大,学习曲线非常陡。

How might a beginning trader assess an option's value? One simple method depends on guessing where the underlying contract will be at expiration. If an option position is held to expiration, the option will be worth either zero, if it is at or out-of-the-money, or intrinsic value (parity), if it is in-the money. The purchase of an option will be profitable if its trade price is less than its value at expiration. The sale of an option will be profitable if its trade price is greater than its value at expiration.

对于初学者来说,评估期权价值的一种简单方法是猜测标的合约在到期时的位置。如果将期权持有至到期,那么若期权为平值或虚值,其价值将为零;若为实值,其价值将为内在价值(平价)。购买期权将获利的前提是交易价格低于到期时的价值;卖出期权将获利则是当交易价格高于到期时的价值。

SIMPLE BUY AND SELL STRATEGIES

简单的买入策略和卖出策略

For example, suppose the following options are available with two months remaining to expiration, and the underlying contract trading at 99.00:

例如,假设以下期权可供选择,距离到期还有两个月,而标的合约的交易价格目前为 99.00:

| 85 | 90 | 95 | 100 | 105 | 110 | 115 | |

| Calls | 14.05 | 9.35 | 5.50 | 2.70 | 1.15 | .45 | .20 |

| Puts | .10 | .45 | 1.55 | 3.70 | 7.10 | 11.35 | 16.10 |

Suppose we believe that the underlying contract will rise to at least 108 by expiration. We might then purchase a 100 call for 2.70. If we are correct, and the contract does in fact end at 108, our profit at expiration will be the option's intrinsic value of 8.00 less the 2.70 we originally paid, or 5.30. Given the above prices, if the underlying market rises to 108 by expiration we will show a profit if we purchase any call with an exercise price less than 110. The intrinsic value of each of these options at expiration will be greater than its current price in the marketplace.

假设我们认为标的合约在到期时至少会涨到 108。我们可能会以 2.70 的价格购买一个行权价为 100 的看涨期权。如果我们判断正确,合约最终确实涨到 108,那么到期时我们的利润将是期权的内在价值 8.00 减去我们最初支付的 2.70,即 5.30。根据上述价格,如果标的市场价在到期时上涨到 108,我们购买任何行权价低于 110 的看涨期权都会实现盈利。这些期权在到期时的内在价值将高于它们在市场上的当前价格。

也可以以 1.15 的价格购买一个行权价为 105 的看涨期权。如果最终标的合约确实涨到了 108,那么到期时的利润将是期权的内在价值 3.00 减去我们最初支付的 1.15,即 1.85,也会实现盈利,但是买这个期权的安全边际较低。比如,在到期日,标的合约只涨到了 106,就亏损了;涨到了 107,利润是 .85,利润很低。

What about the 110 and 115 calls? If we believe that 108.00 is a reasonable upside goal for the underlying contract, but consider it unlikely that the price will rise above 110, then we will prefer to be sellers of the 110 and 115 calls. If we sell the 110 call for .45 and the underlying contract never rises above 110.00, the 110 call will expire worthless and we will get to keep the full premium of .45. We can also sell the 115 call for .20, giving us an additional 5 point margin for error. If the underlying contract never rises above 115.00, the 115 call will expire worthless and we will get to keep the full premium of .20.

那么 110 和 115 的看涨期权呢?如果我们认为 108.00 是标的合约合理的上涨目标,但认为价格不太可能超过 110,那么我们会倾向于卖出 110 和 115 的看涨期权。如果我们以 0.45 的价格卖出 110 的看涨期权,而标的合约价格从未超过 110.00,那么 110 的看涨期权将变得一文不值,我们将保留全部 0.45 的权利金。同样,我们可以以 0.20 的价格卖出 115 的看涨期权,这给了我们额外的 5 点误差空间。如果标的合约价格从未超过 115.00,那么 115 的看涨期权也将变得一文不值,我们将保留全部 0.20 的权利金。

We can use the same approach to assess the potential profit from the purchase or sale of a put. As with a call, a put's intrinsic value at expiration must be greater than its trade price in order for the purchase of a put to be profitable. If the underlying contract rises to 108.00 by expiration, any put with an exercise price of 105 or less will be worthless. If we sell any of these puts, we will profit by the full amount of the premium. If we sell the 110 or 115 puts, they will not be totally worthless at expiration because, with the underlying contract at 108.00, they will have intrinsic values of 2.00 and 7.00, respectively. However, this will still be less than their trade prices of 11.35 and 16.10. We will show a profit of 9.35 from the sale of the 110 put and 9.10 from the sale of the 115 put.

我们可以采用相同的方法来评估购买或出售看跌期权的潜在利润。与看涨期权一样,为了使看跌期权的购买变得有利可图,看跌期权在到期时的内在价值必须大于其交易价格。如果标的合约在到期时上涨到 108.00,任何执行价为 105 或更低的看跌期权将会变得毫无价值。如果我们出售任何这些看跌期权,我们将获得全部的权利金收益。出售 110 或 115 的看跌期权在到期时也不会完全无价值,因为当标的合约价格为 108.00 时,它们的内在价值分别为 2.00 和 7.00。然而,这仍然低于它们的交易价格,分别为 11.35 和 16.10。我们将从出售 110 的看跌期权中获利 9.35,从出售 115 的看跌期权中获利 9.10。

As we change our assumptions about the likely price of the underlying contract at expiration, we alter the likely profit or loss from any option position. If, instead of rising to 108.00, the underlying contract actually rises to 120.00, the purchase of the 100 call for 2.70 will result in a profit of 17.30 rather than 5.30. On the other hand, if the underlying contract falls to 90.00, the purchase of the 100 call will result in the loss of the full premium of 2.70. In the latter case, if we sell the 110 put for 11.35, instead of making 9.35 as we would with the underlying contract at 108.00, we will actually lose 865.

随着我们对期权到期时标的合约可能价格的假设变化,我们从任何期权头寸中获得的潜在利润或损失也会相应改变。如果标的合约实际上涨到 120.00,而不是 108.00,那么以 2.70 的价格购买 100 的看涨期权将导致 17.30 的利润,而不是 5.30。另一方面,如果标的合约下跌到 90.00,购买 100 的看涨期权将导致全额权利金 2.70 的损失。在后者情况下,如果我们以 11.35 的价格出售 110 的看跌期权,那么我们不仅不会像标的合约在 108.00 时那样获利 9.35,实际上还会损失 8.65。

Using a value for an option of either zero or intrinsic value, we can graph the profit or loss at expiration from any option trade which we might make today. Such graphs not only enable the new trader to assess the likely profitability of an option trade, but also help him to understand some of the unusual characteristics of options. However, before looking at graphs of various option positions, we ought to look at the profit and loss graph of an underlying contract. Because it is a derivative instrument, an option's value is always dependent on the price of the underlying instrument. At expiration an option's value is totally dependent on the price of the underlying contract. Indeed, if we have an opinion on the likely price of the underlying contract at some date in the future, we don't need to trade options at all. We can simply buy or sell the underlying contract.

利用期权的零值或内在价值,我们可以绘制出从任何今天可能进行的期权交易中到期时的利润或损失图。这些图不仅使新手交易者能够评估期权交易的潜在盈利能力,还帮助他们理解期权的一些独特特性。然而,在查看各种期权头寸的图表之前,我们应该先看看标的合约的利润和损失图。由于期权是一种衍生工具,其价值始终依赖于标的工具的价格。在到期时,期权的价值完全取决于标的合约的价格。实际上,如果我们对未来某个日期标的合约可能的价格有看法,我们根本不需要交易期权。我们可以直接买入或卖出标的合约。

Figure 2-1 shows the value at expiration of both a long and a short position in our example underlying contract taken at the current price of 99.00. The horizontal (x) axis represents the price of the underlying futures contract, and the vertical (y) axis represents the profit or loss from our position. Note that each graph is a straight 45° line extending infinitely far in either direction. (footnote 1: Of course, an underlying price cannot fall below zero, so the downside profit or loss is in theory limited. However, if the price of an underlying contract should go to zero, it will probably seem like an unlimited profit or loss to most traders.) The potential profit or loss to each position is therefore unlimited. Note also that there is a continuous one-to-one relationship between movement in the underlying contract and the value of the position. If we take a long position, for each point the underlying contract rises, we make a point; for each point the underlying contract falls, we lose a point. If we take a short position the situation is just reversed. For each point the underlying contract rises, we lose a point; for each point the underlying contract falls, we make a point.

|

| 图 2-1 标的合约的多头和空头头寸在到期时的价值 |

图 2-1 展示了在当前价格为 99.00 的情况下,标的合约的多头和空头头寸到期时的价值。横轴(x 轴)代表标的期货合约的价格,纵轴(y 轴)代表我们头寸的利润或损失。请注意,每个图都是一条无限延伸的 45°直线,向任一方向延伸(脚注 1:当然,标的合约的价格不可能低于零,因此下行利润或损失在理论上是有限的。然而,如果标的合约的价格确实降至零,对大多数交易者而言,这可能看起来像是无限的利润或损失。)。因此,每个头寸的潜在利润或损失都是无限的。同时,标的合约的价格变动与头寸价值之间存在连续的一对一关系。如果我们持有多头头寸,标的合约每上涨一个点,我们就赚一个点;标的合约每下跌一个点,我们就亏一个点。如果我们持有空头头寸,则情况正好相反:标的合约每上涨一个点,我们就亏一个点;标的合约每下跌一个点,我们就赚一个点。

Using the same evaluation method, Figure 2-2 shows the profit or loss at expiration from the purchase of a 100 call at 2.70. Note that in this case the graph is no longer a straight line. If the underlying contract falls below 100 at expiration the 100 call will be out-of-the-money and therefore worthless, and we will lose the full 2.70 we paid for the call. Above 100, the call will be in-the-money, and will increase in value at the same rate as the underlying contract; the position will gain one point in value for each point rise in the value of the underlying contract. If the underlying contract finishes at 102.70, the 100 call will be worth its intrinsic value of 2.70, and we will break exactly even. Above 102.70, the profit from the purchase of the 100 call is potentially unlimited, just like a long position in the underlying contract.

|

| 图 2-2 以 2.70 的价格购买 100 的看涨期权的价值 |

使用相同的评估方法,图 2-2 展示了以 2.70 的价格购买 100 的看涨期权在到期时的利润或损失。请注意,在这种情况下,图形不再是一条直线。如果在到期时标的合约价格低于 100,则 100 的看涨期权将处于虚值状态,因此将变得毫无价值,我们将损失为该看涨期权支付的全部 2.70。超过 100 时,该看涨期权将处于实值状态,其价值将以与标的合约相同的速度增加;每当标的合约的价值上涨一个点,该头寸的价值也将增加一个点。如果标的合约最终达到 102.70,则 100 的看涨期权的内在价值为 2.70,我们将正好持平。在 102.70 以上,购买 100 的看涨期权的利润是潜在无限的,和标的合约的多头头寸一样。

RISK/REWARD CHARACTERISTICS

风险 / 收益特征

The profit and loss graph of a long call position at expiration will always have the same general shape as the graph in Figure 2-2. The position will always have limited downside risk and unlimited upside profit potential. The exact point at which the maximum loss will occur is determined by the exercise price (the point at which the graph bends) and the price of the option. Graphs of long positions in the 95, 100, and 105 calls are shown in Figure 2-3.

多头看涨期权在到期时的盈亏图形始终与图 2-2 中的图形相似。该头寸的下行风险始终有限,而上行利润潜力则无限。最大损失发生的确切点由行权价(图形弯曲的点)和期权价格决定。图 2-3 展示了行权价为 95、100 和 105 的多头看涨期权的图形。

|

| 图 2-3 行权价为 95、100 和 105 的多头看涨期权的盈亏图形 |

Figure 2-4 represents the profit and loss from a short position in the 95, 100, and 105 calls. These are simply inversions of the long call graphs. The positions now have profit potential limited to the amount of the premium for which they were sold, and unlimited upside risk similar to a short position in the underlying contract.

图 2-4 展示了行权价为 95、100 和 105 的看涨期权的空头头寸的利润和损失。这些图形只是多头看涨期权图形的反转。此时,这些头寸的利润潜力被限制在出售时获得的权利金金额内,而风险上行的空间则是无限的,类似于标的合约的空头头寸。

|

| 图 2-4 行权价为 95、100 和 105 的空头看涨期权的盈亏图形 |

Figure 2-5 represents long positions in the 95, 100, and 105 puts. The risk/ reward characteristics of these positions are similar to long call positions, but now the limited risk is on the upside and the unlimited profit potential is on the downside. The position will break even if the underlying contract falls below the exercise price by exactly the amount of the option's trade price. Below that break-even price the potential profit to the position is unlimited, increasing by one point for each point drop in the price of the underlying contract.

图 2-5 展示了行权价为 95、100 和 105 看跌期权的多头头寸。这些头寸的风险 / 收益特征类似于多头看涨期权,但现在上行时风险有限,而下行时利润有无限的潜力。如果标的合约的价格恰好低于执行价格与期权交易价格之差,该头寸将持平。在该持平价格以下,头寸的潜在利润是无限的,每当标的合约的价格下跌一个点,头寸的利润将增加一个点。

|

| 图 2-5 行权价为 95、100 和 105 的看跌期权的多头头寸的盈亏图形 |

The short put positions in Figure 2-6 are inversions of the graphs in Figure 2-5. Each position has upside profit potential limited to the amount of the trade price, and a potentially unlimited loss similar to a long position in the underlying contract.

图 2-6 中的空头看跌期权头寸是图 2-5 中图形的反转。每个头寸的上行利润潜力被限制在交易价格的金额范围内,而潜在的损失则类似于标的合约的多头头寸,是无限的。

|

| 图 2-6 行权价为 95、100 和 105 看跌期权的空头头寸的盈亏图形 |

Figures 2-3 through 2-6 illustrate two of the most important characteristics of options: buyers of options have limited risk and potentially unlimited reward; sellers of options have limited reward and potentially unlimited risk. More specifically, net buyers (sellers) of calls have unlimited upside reward (risk), and net buyers (sellers) of puts have unlimited downside reward (risk).

图 2-3 至图 2-6 展示了期权的两个最重要特征:期权买方具有有限的风险和潜在无限的收益;而期权卖方则具有有限的收益和潜在无限的风险。更具体地说,买入看涨期权的净买方(卖方)具有无限的上行收益(风险),而买入看跌期权的净买方(卖方)具有无限的下行收益(风险)。

At this point, new traders tend to have a common reaction. Why would anyone ever want to do anything other than buy options? After all, a buyer of options has limited risk and unlimited profit potential, while a seller of options has limited profit potential and unlimited risk. Who in their right mind would choose the latter over the former?

此时,新手交易者往往会有一个共同的反应:为什么有人会选择除了买入期权之外的任何其他操作?毕竟,期权买方具有有限的风险和无限的利润潜力,而期权卖方则只有有限的利润潜力和无限的风险。谁会选择后者而不是前者呢?

The prospect of unlimited risk certainly seems a good reason to avoid a trade. However, If a trader gives some thought to the matter, he will realize that almost any trade in a stock or commodity market carries with it unlimited risk. A violent adverse move which does not give a trader time to cover his position is always possible. Yet traders take long and short positions in stocks and commodities all the time. The only explanation must be that they believe the chances of sustaining a catastrophic loss must be small, so small that the potential profit justifies the risk of unlimited loss.

无限风险的前景确实似乎是避免交易的一个很好的理由。然而,如果交易者认真考虑这个问题,他会意识到,几乎任何股票或商品市场的交易都伴随着无限风险。总是有可能出现剧烈的不利波动,使交易者没有时间平仓。然而,交易者仍然在股票和商品中进行多头和空头头寸。唯一的解释是,他们相信遭受灾难性损失的机会应该很小,小到足以使潜在的利润值得承担无限损失的风险。

Option traders learn that the limited or unlimited risk/reward characteristics of a trade are not the only considerations. At least as important is the probability of that unlimited profit or loss. As an example, suppose a trader is considering a trade which has only two possible outcomes. In one case the trader will double his money; in the other case he will go broke. It may seem that a rational trader will avoid such a trade because the reward does not appear to justify the risk. But suppose the probability of the second outcome is only one chance in a million, Suppose in fact that the exact circumstances which will cause the trader to go broke have never before occurred. Now how does the trade look? The reward is still limited and the risk unlimited. Yet most traders would probably make the trade in spite of the potentially disastrous results.

期权交易者逐渐了解到,交易的有限或无限风险 / 收益特征并不是唯一的考虑因素。至少同样重要的是这种无限利润或损失的概率。例如,假设一个交易者正在考虑一笔只有两种可能结果的交易。在一种情况下,交易者将获得双倍的利润;而在另一种情况下,他将破产。看起来理性的交易者会避免这样的交易,因为收益似乎不足以证明风险的合理性。但是,假设第二种结果的概率只有百万分之一,实际上导致交易者破产的具体情况从未发生过。此时,这笔交易看起来如何?收益仍然是有限的,风险却是无限的。然而,尽管可能会导致灾难性后果,大多数交易者可能仍会选择进行这笔交易。

In addition to the potential risk and reward associated with any trade, a trader must also consider the likelihood of the various outcomes. Is the reward, even a limited one, sufficient to offset the risk, albeit an unlimited one? Sometimes it is; sometimes it isn't.

除了与任何交易相关的潜在风险和收益,交易者还必须考虑各种结果发生的可能性。即使是有限的收益,是否足以抵消风险,即使这个风险是无限的?有时是这样;有时则不是。

图 2-3、2-4、2-5 和 2-6 必须烂熟于心。

至此,我们对期权的基础知识已经了解得差不多了,再深入下去就涉及到了很多理论。

COMBINATION STRATEGIES

组合策略

When considering an option trade we need not restrict ourselves to the purchase or sale of individual options. We can also combine option positions to form new positions with their own unique characteristics. Figure 2-7 shows the profit and loss at expiration from the combined purchase of a 100 call for 2.70, and a 100 put for 3.70. Here we have paid a total of 6.40, which will be our maximum loss if both options expire worthless. This will happen only if the underlying contract is right at 100 at expiration. If the underlying contract is above 100 at expiration the put will be worthless, but the call will act like a long underlying position, gaining one point in value for each point the underlying contract rises. If the underlying contract is below 100 the call will be worthless, but the put will act like a short underlying position, gaining one point in value for each point the underlying contract falls. In order for the position to do no worse than break even, It must be worth at least the 6.40 we originally paid. This will occur if either the 100 call or the 100 put turns out to be worth 6.40. At expiration, the underlying contract must be at or above 106.40, or at or below 93.60. Outside of this range, the potential profit is unlimited.

|

| 图 2-7 多头看涨期权和多头看跌期权的组合的盈亏特征 |

在考虑期权交易时,我们不必局限于买入或卖出单个期权。我们还可以将期权头寸组合起来,形成具有独特特征的新头寸。图 2-7 展示了同时买入 100 行权价的看涨期权(价格为 2.70)和 100 行权价的看跌期权(价格为 3.70)在到期时的盈亏情况。我们总共支付了 6.40,这将是我们最大的损失,前提是两份期权都变得毫无价值。这只会在标的合约在到期时正好位于 100 时发生。如果到期时标的合约价格高于 100,看跌期权将变得毫无价值,但看涨期权将像一个多头头寸一样运作,标的合约每上涨 1 点,看涨期权的价值就会增加 1 点。如果标的合约在到期时低于 100,看涨期权将变得毫无价值,但看跌期权将像空头头寸一样运作,标的合约每下跌 1 点,看跌期权的价值就会增加 1 点。为了不亏损并至少保本,该组合头寸的价值必须达到我们最初支付的 6.40。这将发生在 100 看涨期权或 100 看跌期权的价值至少为 6.40 时。到期时,标的合约必须处于 106.40 或更高,或 93.60 或更低的水平。在这个区间之外,潜在的利润是无限的。

在第八章会提到,这是多头跨式期权,同时买入一个看涨期权和一个看跌期权,两个期权的到期日和行权价都一样。

Under what conditions might we initiate the position in Figure 2-7? Such a position might be sensible if we thought a large move in the underlying contract would take place in the near future, but were uncertain as to the direction of that move. If the move were sufficiently large (above 106.40 or below 93.60) the position would be profitable. Of course we might also take the opposite view, that the underlying contract was unlikely to either fall below 93.60 or rise above 106.40. Under these conditions we might prefer to sell both the 100 call and 100 put (Figure 2-8). Now our profit is limited to the total premium of 6.40, while our risk in either direction is unlimited. But if we feel strongly that the underlying contract is likely to stay in the 93.60-106.40 range through expiration, the risk might be worth taking.

|

| 图 2-8 空头看涨期权和空头看跌期权的组合的盈亏特征 |

在什么情况下我们会建立图 2-7 中的头寸?如果我们认为标的合约在不久的将来会出现大幅波动,但不确定波动的方向,这样的头寸可能是合理的。如果波动足够大(超过 106.40 或低于 93.60),该头寸将是盈利的。当然,我们也可以持相反的观点,认为标的合约不太可能跌破 93.60 或升破 106.40。在这种情况下,我们可能更倾向于同时卖出 100 行权价的看涨期权和 100 行权价的看跌期权(见图 2-8)。此时我们的利润将限于总权利金 6.40,而在任一方向上的风险都是无限的。但如果我们坚信标的合约在到期前会保持在 93.60-106.40 的区间内,这种风险可能是值得承担的。

在第八章会提到,这是空头跨式期权,同时卖出一个看涨期权和一个看跌期权,两个期权的到期日和行权价都一样。

Suppose we take a view similar to that in Figure 2-8, that the underlying contract is unlikely to make a big move in either direction. But because there is always a chance we could be wrong, we might want to increase our margin for error by increasing our range of profitability beyond the 93.60-106.40 range. Instead of selling a 100 call and a 100 put, we might sell a 95 put for 1.55 and a 105 call for 1.15. This position (Figure 2-9) will realize its maximum profit of 2.70 anywhere within the 95-105 range, where both options will expire worthless. We won't lose money unless the underlying contract finishes below 92.30 or above 107.70 at expiration. In the former case the 95 put will be worth at least 2.70, and in the latter case the 105 call will be worth at least 2.70. There is, as always, a tradeoff for this increased range of profitability. Our maximum profit now is only 2.70, whereas in Figure 2-8 it was 6.40. In return for a reduced risk, we must be satisfied with a reduced profit potential. Option traders are constantly required to make these types of tradeoffs between risk and reward. If a potential reward is big enough, it may be worth taking a big risk. But if the potential reward is small, the accompanying risk should also be small.

|

| 图 2-9 空头 95 的看跌期权和空头 105 的看涨期权的组合的盈亏特征 |

假设我们持有与图 2-8 类似的观点,认为标的合约不太可能朝任何一个方向大幅波动。但由于我们始终有可能判断错误,因此我们可能希望通过扩大盈利范围来增加容错空间,而不仅限于 93.60-106.40 的区间。与其卖出 100 看涨期权和 100 看跌期权,我们可以卖出一个 95 看跌期权,价格为 1.55,和一个 105 看涨期权,价格为 1.15。这个仓位(如图 2-9 所示)将在 95 到 105 的区间内实现最大利润 2.70,因为此时两份期权都将作废。只有在标的合约到期时低于 92.30 或高于 107.70 时,我们才会亏损。前一种情况下,95 看跌期权的价值将至少为 2.70;后一种情况下,105 看涨期权的价值将至少为 2.70。这里和以往一样,扩大盈利区间的代价是收益的减少。现在我们的最大利润仅为 2.70,而在图 2-8 中为 6.40。为了降低风险,我们必须接受较低的利润潜力。期权交易者经常需要在风险与回报之间进行这种权衡。如果潜在回报足够大,或许值得承担较大的风险;但如果潜在回报较小,那么相应的风险也应较低。

在第八章会提到,这是空头勒式期权,同时卖出一个看涨期权和一个看跌期权,且两者到期时间相同,但行权价不同,看涨期权的价格高于看跌期权的价格。

同样还有多头勒式期权,同时买入一个看涨期权和一个看跌期权,且两者到期时间相同,但行权价不同,看涨期权的价格高于看跌期权的价格。

The positions in Figures 2-7, 2-8, and 2-9 all have either unlimited reward or unlimited risk because they are either net long or net short options. If we purchase and sell equal numbers of options of the same type, we can create positions which have both limited risk and limited reward. For example, we might buy a 90 call for 9.35 and sell a 100 call for 2.70, for a total debit of 6.65 (Figure 2-10). If the underlying contract finishes below 90.00 both options will expire worthless and we will lose our total investment of 6.65. If the underlying contract finishes above 100, the 90 call, which we own, will be worth exactly 10 points more than the 100 call, and we will realize the maximum profit of 3.35. Between 90 and 100 the position will be worth some amount between zero and 10 points. In order to do no worse than break even we must recoup our original investment of 6.65. We will be able to do this if the underlying contract is at 96.65 or higher at expiration. The 90 call will then be worth at least 6.65. Like the outright purchase of a call, this position wants the market to rise so that we will realize our maximum profit of 3.35. Here, however, we are willing to give up the unlimited upside profit potential associated with the outright purchase of a 90 call, in return for the partial downside protection afforded by the sale of the 100 call. The position is bullish, but with both limited risk and limited reward.

|

| 图 2-10 买入和卖出数量相等的相同类型期权的看涨头寸 |

图 2-7、2-8 和 2-9 中的仓位要么有无限收益,要么有无限风险,因为它们是净多头或净空头期权。如果我们同时买入和卖出数量相等的相同类型期权,就可以构建既有有限风险又有有限收益的仓位。例如,我们可以以 9.35 买入一份 90 行权价的看涨期权,同时以 2.70 卖出一份 100 行权价的看涨期权,总共支出 6.65(见图 2-10)。如果标的合约到期时价格低于 90.00,两份期权都将变得一文不值,我们将损失全部 6.65 的投资。如果标的合约价格高于 100,持有的 90 看涨期权将比 100 看涨期权高出 10 点,我们将获得最大利润 3.35。在 90 和 100 之间时,该仓位的价值会介于 0 到 10 点之间。为了保本,我们至少需要收回原始的 6.65 投资。当标的合约在到期时达到或超过 96.65 时,我们可以实现这一点,因为此时 90 看涨期权的价值至少为 6.65。与直接买入看涨期权类似,这个仓位期望市场上涨,从而实现最大 3.35 的利润。但我们愿意放弃直接买入 90 看涨期权带来的无限上涨利润,换取通过卖出 100 看涨期权获得的部分下行保护。这个仓位看涨,但具有限制的风险和收益。

在第九章会提到,这是 bull call spread,牛市看涨期权价差,看富途牛牛的解释。还有 bull put spread,牛市看跌期权价差,也可以达到同样的目的,看富途牛牛的解释。

If we are bearish on the market we might create a position with limited risk and limited reward by inverting the position in Figure 2-10. That is, we might sell the 90 call and purchase the 100 call. Now our potential profit is limited to 6.65 if the market finishes below 90, and our potential loss is limited to 3.35 if the market finishes above 100.

如果我们对市场看空,可以通过反转图 2-10 中的仓位来创建一个有限风险和有限收益的仓位。也就是说,我们可以卖出 90 看涨期权并买入 100 看涨期权。如果市场在到期时低于 90,我们的潜在利润将限制在 6.65;如果市场在到期时高于 100,我们的潜在损失将限制在 3.35。We can also create a bearish position with both limited risk and limited reward by purchasing a put with a higher exercise price and selling a put with a lower exercise price. For example, we might buy a 105 put for 7.10 and sell a 100 put for 3.70, for a total debit of 3.40 (Figure 2-11). If the underlying contract is below 100 at expiration, the 105 put will be worth exactly 5 points more than the 100 put, and we will realize our maximum profit of 1.60. If the underlying contract is above 105 at expiration, both options will be worthless and we will lose our entire investment of 3.40. The position will do no worse than break even if the underlying contract is at or below 101.60, for then the 105 put will be worth at least 3.40. Like the outright purchase of a put, this position is bearish. However, we have chosen to give up the unlimited downside profit potential associated with the outright purchase of the 105 put in return for the partial upside protection afforded by the sale of the 100 put.

|

| 图 2-11 买入和卖出数量相等的相同类型期权的看跌头寸 |

我们还可以通过购买行权价较高的看跌期权并出售行权价较低的看跌期权来创建一个既有限风险又有限收益的看空仓位。例如,我们可以以 7.10 的价格买入一个 105 看跌期权,同时以 3.70 的价格卖出一个 100 看跌期权,总共支出 3.40(如图 2-11 所示)。如果标的合约在到期时低于 100,105 看跌期权将比 100 看跌期权高出正好 5 点,我们将获得最大利润 1.60。如果标的合约在到期时高于 105,两个期权都会变得一文不值,我们将损失全部的 3.40 投资。如果标的合约在到期时价格达到或低于 101.60,那么这个仓位的表现不会低于保本,因为那时 105 看跌期权至少会价值 3.40。与直接购买看跌期权类似,这个仓位也是看空的。然而,我们选择放弃直接购买 105 看跌期权所带来的无限下行利润潜力,以换取通过出售 100 看跌期权所获得的部分上行保护。

在第九章会提到,这是 bear call spread,熊市看涨期权价差,看富途牛牛的解释;还有 bear put spread,熊市看跌期权价差,损益图一样,看富途牛牛的解释。

bull call spread,bull put spread,bear call spread,bear put spread,是垂直价差(vertical spread)的四种。

CONSTRUCTING AN EXPIRATION GRAPH

构建到期盈亏图

From the foregoing examples, we can formulate some simple rules for drawing expiration profit and loss graphs:

根据前面的例子,我们可以总结出一些绘制到期盈亏图的简单规则:

- If the graph bends, it will do so at an exercise price. Therefore, we can calculate the profit or loss at each exercise price involved and simply connect these points with straight lines.

如果图线出现拐点,拐点会出现在行权价处。因此,我们可以计算每个相关行权价下的盈亏,然后用直线将这些点连接起来。 - If the position is long and short equal numbers of calls (puts), the potential downside (upside) risk or reward will be equal to the total debit or credit required to establish the position.

如果仓位是等量的看涨期权(或看跌期权)多头和空头,潜在的下行(或上行)风险或收益将等于建仓时所需的总支出(借记)或收入(贷记)。 - Above the highest exercise price all calls will go into the-money, so the entire position will act like an underlying position which is either long or short undertying contracts equal to the number of net long or short calls. Below the lowest exercise price all puts will go into-the-money, so the entire position will act like an underlying position which is either long or short underlying contracts equal to the number of net long or short puts.

在最高行权价以上,所有看涨期权都会进入实值状态,因此整个仓位将表现得像标的资产的头寸,等同于净多头或净空头看涨期权数量的标的合约。在最低行权价以下,所有看跌期权都会进入实值状态,因此整个仓位将表现得像标的资产的头寸,等同于净多头或净空头看跌期权数量的标的合约。

To see how we can use these rules to construct an expiration graph, consider the following position:

long one 95 call at 5.50

short three 105 calls at 1.15

为了理解如何运用这些规则来构建到期图表,考虑以下仓位:

买入一份 95 看涨期权,价格为 5.50

卖出三份 105 看涨期权,每份价格为 1.15

The first step is to determine the profit or loss at each exercise price (95 and 105). If the underlying contract finishes at 95, both the 95 and 105 calls will be worthless. Since the entire position was established for a debit of 2.05 (-5.50 + 3 x 1.15), at 95 the position will show a loss of 2.05. If the underlying contract finishes at 105, the 95 call will be worth 10.00 and the 105 calls will be worthless. Since we own the 95 call, the position will be worth 10 points less the initial debit of 2.05, or 7.95. We can plot and connect these two points on a graph (Figure 2-12a).

第一步是确定每个行权价(95 和 105)的利润或亏损。如果标的资产价格在 95 时到期,95 和 105 的看涨期权都将变得一文不值。因为整个仓位是以 2.05 的净支出建立的(-5.50 + 3 x 1.15),所以标的价格在 95 时,仓位将显示 2.05 的亏损。如果标的价格在 105 时到期,95 看涨期权将价值 10.00,105 看涨期权仍然没有价值。因为我们持有 95 看涨期权,仓位的价值为 10 点减去最初的 2.05 净支出,结果为 7.95。我们可以在图表上绘制并连接这两点(图 2-12a)。

Next, we note that there are no puts involved in this position, so the maximum downside loss we can incur is the 2.05 debit required to establish the position. This loss will occur anywhere below 95 (Figure 2-12b).

接下来,由于这个仓位中没有涉及看跌期权,所以我们可以承受的最大亏损就是建立仓位时的 2.05 净支出。这个亏损将在标的价格低于 95 时发生(图 2-12b)。

Finally, above 105 both the 95 and 105 calls will go into-the-money, so that all options will begin to act like long underlying contracts. We will be long one underlying contract in the form of a 95 call, and short three underlying contracts in the form of three 105 calls. The net result is that above 105 we have a position which is equivalent to being short two underlying contracts. For each point increase in the price of the underlying contract, our position will lose two points (Figure 2-12c).

最后,当标的价格超过 105 时,95 和 105 的看涨期权都将进入实值状态,所有期权将开始表现得像标的合约的头寸。我们通过 95 看涨期权持有一个标的合约多头,并通过三份 105 看涨期权持有三个标的合约的空头。最终结果是,标的价格超过 105 时,我们的仓位等同于空两份标的合约。标的价格每上涨 1 点,我们的仓位将亏损 2 点(图 2-12c)。

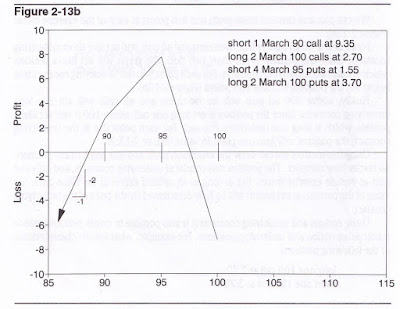

Applying this method to a more complex example, what would be the expiration graph of the following position?

short one 90 call at 9.35

long two 100 calls at 2.70

short four 95 puts at 1.55

long two 100 puts at 3.70

将此方法应用于一个更复杂的例子,以下仓位的到期图表将会是什么样的?

卖出一份 90 看涨期权,价格为 9.35

买入两份 100 看涨期权,每份价格为 2.70

卖出四份 95 看跌期权,每份价格为 1.55

买入两份 100 看跌期权,每份价格为 3.70

First, what happens at the three exercise prices involved? At 90 we have:

90 call +9.35

100 calls 2 × 2.70

95 puts 4 × 3.45

100 puts +2 × 6.30

Total +2.75

首先,看看在涉及的三个行权价下会发生什么情况。在 90 时:

90 看涨期权 +9.35

100 看涨期权 2 × 2.70

95 看跌期权 4 × 3.45

100 看跌期权 +2 × 6.30

总计:+2.75

At 95 we have:

90 call +4.35

100 calls -2 × 2.70

95 puts +4 × 1.55

100 puts +2 x1.30

Total +7.75

在 95 时:

90 看涨期权 +4.35

100 看涨期权 -2 × 2.70

95 看跌期权 +4 × 1.55

100 看跌期权 +2 × 1.30

总计:+7.75

And at 100 we have:

90 call .65

100 calls 2 × 2.70

95 puts +4 × 1.55

100 puts -2 × 3.70

Total -7.25

在 100 时:

90 看涨期权 +0.65

100 看涨期权 2 × 2.70

95 看跌期权 +4 × 1.55

100 看跌期权 -2 × 3.70

总计:-7.25

We can plot and connect these profit and loss points at each of the exercise prices (Figure 2-13a).

我们可以将这些在每个行权价下的利润和亏损点绘制并连接起来(图 2-13a)。

Next, below 90 all calls will be worthless and all puts will act like short underlying contracts. Since the position is net short two puts, the graph will act like a position which is long two underlying contracts. For each point that the underlying contract falls below 90, the position will lose two points (Figure 2-13b).

接下来,在价格低于 90 时,所有看涨期权将变得毫无价值,而所有看跌期权将表现得像做空的标的资产。由于该头寸净空两份看跌期权,图表将表现得像持有两份标的资产的多头头寸。每当标的资产价格跌破 90 时,该头寸将每下降一个点损失两点(图 2-13b)。

Finally, above 100 all puts will be worthless and all calls will act like long underlying contracts. Since the position is net long one call, above 100 it will act like a position which is long one underlying contract. For each point rise in the underlying contract, the position will gain one point in value (Figure 2-13c).

最后,当价格高于 100 时,所有看跌期权将变得毫无价值,而所有看涨期权将表现得像持有标的资产的多头头寸。由于该头寸净多一份看涨期权,在价格高于 100 时,该头寸将表现得像持有一份标的资产的多头头寸。每当标的资产价格上涨一个点,该头寸的价值将增加一个点(图 2-13c)。

Using this method we can draw the expiration profit and loss graph of any position, no matter how complex. The position may consist of underlying contracts, and calls and puts at various exercise prices. But as long as all options expire at the same time, the value of the position at expiration will be fully determined by the price of the underlying contract.

我们可以用这种方法绘制任何头寸的到期损益图,不论其多么复杂。头寸可以包含标的资产、以及不同行权价格的看涨和看跌期权。但只要所有期权在同一时间到期,头寸在到期时的价值将完全由标的资产的价格决定。

Using options and underlying contracts it is also possible to create positions which mimic other option and underlying positions. For example, what are the characteristics of the following position?

long one 100 call at 2.70

short one 100 put at 3.70

利用期权和标的资产,我们还可以构建出模拟其他期权和标的资产的头寸。例如,下面头寸有什么特征?

做多一份行权价为 100 的看涨期权,成本 2.70

做空一份行权价为 100 的看跌期权,收益 3.70

With the underlying contract above 100 at expiration, the 100 put will be worthless and the 100 call will act like a long underlying contract. With the underlying contract below 100 at expiration, the 100 call will be worthless and the 100 put will act like a short underlying contract. However, since the position is short the 100 put, when the 100 put is in the money it will act like a long underlying contract. In other words, this position will mimic a long underlying position regardless of where the underlying contract is at expiration (Figure 2-14). The only real difference between the option position and a long position in the underlying contract is that the option position will create a credit of one point.

在到期时,如果标的资产价格高于 100,100 看跌期权将变得毫无价值,而 100 看涨期权将表现得像一个多头标的资产头寸。如果标的资产价格低于 100,100 看涨期权将变得毫无价值,而 100 看跌期权将表现得像一个空头标的资产头寸。然而,由于该头寸是做空的 100 看跌期权,当 100 看跌期权处于价内时,它会表现得像一个多头标的资产头寸。换句话说,无论到期时标的资产价格如何,该头寸都会模拟一个多头标的资产头寸(见图 2-14)。唯一的区别在于这个期权头寸会产生一个点的信用额。

Or consider the following position:

long one 90 put at .45

short one 100 call at 2.70

long one underlying contract at 99.00

再考虑以下头寸:

做多一份行权价为 90 的看跌期权,成本 0.45

做空一份行权价为 100 的看涨期权,收益 2.70

做多一份标的资产,价格为 99.00

The value of this position at expiration is given in Figure 2-15. Note the similarity between this position and the one in Figure 2-10. The only difference appears to be that we replaced the long 90 call with the combination of a long 90 put and a long underlying contract. Therefore, a long 90 put and a long underlying contract together must mimic a long 90 call. As proof, the reader should draw the expiration profit and loss graph of the following two positions:

long a 90 call at 9.35

long a 90 put at .45 and long an underlying contract at 99.00

这个头寸到期时的价值见图 2-15。请注意,该头寸与图 2-10 中的头寸非常相似。唯一的区别在于我们用一个做多 90 看跌期权和一个做多标的资产的组合,替换了做多 90 看涨期权。因此,做多 90 看跌期权和做多标的资产的组合必须模拟一个做多 90 看涨期权。为证明这一点,读者可以绘制以下两个头寸的到期损益图:

做多一份行权价为 90 的看涨期权,成本 9.35

做多一份行权价为 90 的看跌期权,成本 0.45,并且做多一份标的资产,价格为 99.00

Although there will be a small difference in the profit and loss to each position, both positions will have graphs with the same general shape.

虽然这两个头寸的损益略有不同,但两者的图形轮廓是相同的。

The reader who is new to options may find it useful to sit down with the business section of a newspaper and create and graph a variety of option and underlying positions. (footnote 2: In the United States, Investor's Business Daily, the New York Times, and The Wall Street Journal all carry extensive listings of exchange traded futures options and stock options.) This will enable him to become comfortable with many of the concepts introduced in the first two chapters, and will make the subsequent material that much easier to understand. Typical newspaper listings for futures options and stock options are shown in Figure 2-16.

对于刚接触期权的读者来说,可能会觉得有益的是,通过阅读报纸的财经版面,创建并绘制各种期权和标的资产头寸的图表(脚注 2:在美国,《投资者商业日报》、《纽约时报》和《华尔街日报》都刊载了大量的交易所交易期权和股票期权的列表)。这将有助于熟悉前两章中介绍的许多概念,并使后续的内容更加易于理解。图 2-16 展示了报纸中期货期权和股票期权的典型列表。

While elementary strategies such as the ones discussed in this chapter are a convenient method of introducing the new trader to basic option characteristics, in actual practice it is very unlikely that a trader will put on a position and let it go to expiration. Even if he were to initiate a position with such an intent, he would be foolish indeed to simply walk away from the position and come back at expiration to find out whether he had made or lost money. As market conditions change, a position which sensible yesterday may not seem quite so sensible today. Based on new conditions the trader may want to-indeed, may have to —alter his strategy. This is true for all traders, not just for option traders. A trader who buys stock in the belief that it will rise would be foolish not to reassess his position if the stock were to unexpectedly drop several points. An option trader who sells 105 calls in the belief that the underlying contract will never rise above 105 would likewise be foolish not to reassess the situation if the underlying contract were to make a rapid upward move from 99 to 104. He may still believe that the underlying contract will not rise above 105, but he is unlikely to have the same degree of confidence. Every trader reserves the right to make a more intelligent decision today than he made yesterday.

虽然本章讨论的基础策略是引导新手了解期权基本特征的一种方便方法,但在实际操作中,交易者很少会设置一个头寸并持有到期。即便交易者最初是打算这么做的,但如果他只是简单地放置不管,等到到期时再来看自己是赚了还是亏了,那无疑是愚蠢的。随着市场条件的变化,昨天看起来合理的头寸今天可能就不再那么合理了。基于新的市场情况,交易者可能会想要——甚至不得不——调整他的策略。这不仅适用于期权交易者,也适用于所有交易者。如果一个交易者买入股票是因为他相信价格会上涨,那么当股票价格意外下跌时,不重新评估自己的头寸显然是不明智的。同样,一个期权交易者如果卖出 105 的看涨期权,认为标的合约不会涨过 105,那么当标的价格从 99 快速上升到 104 时,不重新评估情况也是愚蠢的。他可能仍然相信标的合约不会超过 105,但他的信心可能不会像之前那么强烈。每个交易者都有权利做出比昨天更明智的决策。

The serious trader must be able to identify potentially profitable strategies given current market conditions. But he must also be able to adjust to changing market conditions and to take protective measures when the market moves adversely. In the next chapter we will begin our investigation of basic option pricing theory, and show how this theory can be used to help a trader achieve these goals.

严肃的交易者必须能够根据当前市场状况识别出潜在的盈利策略,同时也要能够应对市场变化,并在市场不利时采取保护措施。下一章我们将开始研究基本的期权定价理论,并展示如何利用这些理论帮助交易者实现这些目标。

No comments:

Post a Comment